How Will I Deduct Overtime Pay On My Taxes Next Year?

This site utilizes Google Analytics, Google AdSense, as well as participates in affiliate partnerships with various companies including Amazon. Please view the privacy policy for more details.

That “Big Beautiful Bill” (which I dislike the name - I’m not a fan of big bills, and the name is indicative of Trump’s limited vocabulary) that was passed earlier this year means that the overtime my wife earns isn’t going to be taxed this year.

But - being the paperwork nerd I am - I wanted to know how I’m going to claim that deduction.

It’s simple - really:

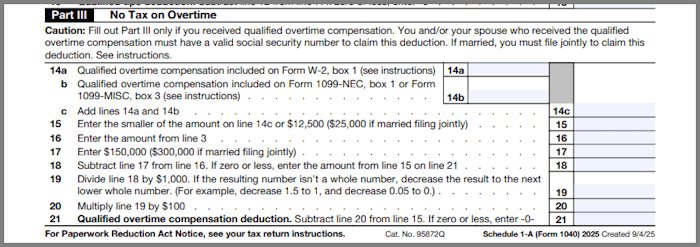

I’ll enter her W-2 tips on line 14a on the new Schedule 1-A (Form 1040), and, after figuring out the amount for lines 21 and 38, I’ll enter the amount from line 38 onto line 13b on the regular Form 1040.

At least according to the draft Schedule 1-A and draft Form 1040.

Schedule 1-A also has the deductions for No Tax on Tips (part II), No Tax on Car Loan Interest (part IV), and Enhanced Deduction for Seniors (part V).

I told you I was a bit of a dork - yes, I’ve been reading the IRS’s draft tax forms to get a heads up on next tax season.

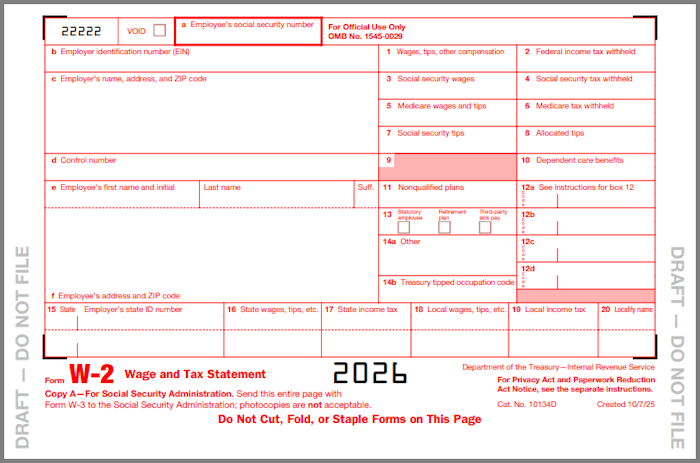

What’s interesting is that - at least at the time of writing - the draft W-2 doesn’t seem to have a separate box for overtime or just tips:

There’s a spot for “social security tips” and “allocated tips”, but that was there on previous years, as well.

It’s now October, so only three or four months until tax season begins, so we’ll find out then.

Leave a Reply