May 13, 2025

Child Tax Credit and Dependent Care Expenses Credit Gutted for 2023

January 25, 2023

So I’ve started doing my Federal taxes and I had a bit of a sticker shock, at least when comparing it to my previous year’s Federal taxes.

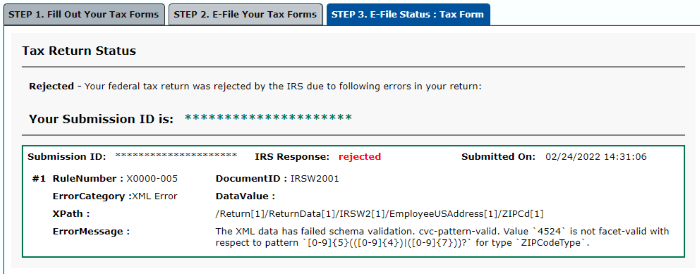

Free File Fillable Forms Federal Tax Return XML Error X0000-005 (Again!)

March 24, 2022

Free File Fillable Forms Federal Tax Return XML Error X0000-005

March 7, 2022

The Murky Waters of Tax Deductions for Travel Bloggers

June 29, 2021

Fixing Validation Errors on my 2019 Free File Fillable Forms Federal Tax Return

March 10, 2020

What is this "5-Section 199A dividends" line on my 2019 Robinhood 1099-DIV?

February 27, 2020

Example Schedule C for Cryptocurrency Mining

February 28, 2019

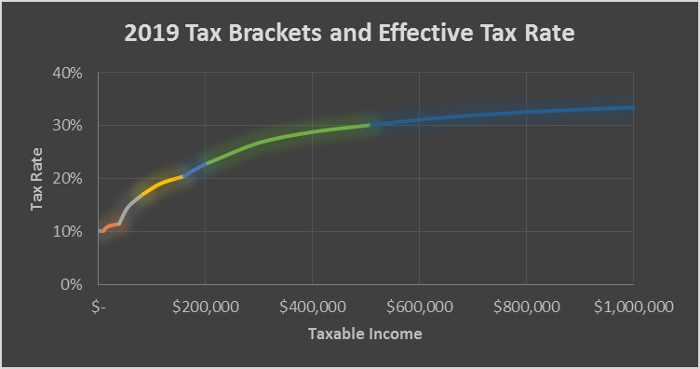

How Marginal Tax Rates Affect Effective Rates

January 30, 2019

How Do You Report Virtual Currency Transactions to the IRS?

January 25, 2019

Five Rivers Metroparks Levy - Why I'm Voting No in 2018

October 23, 2018

One of the two issues on the ballot across Montgomery County, Ohio this election cycle is the Five Rivers Metroparks Levy. Despite using - and enjoying - the Metroparks, I intend to vote No on this ballot initiative. It is the intent of this post to explain my reasoning.

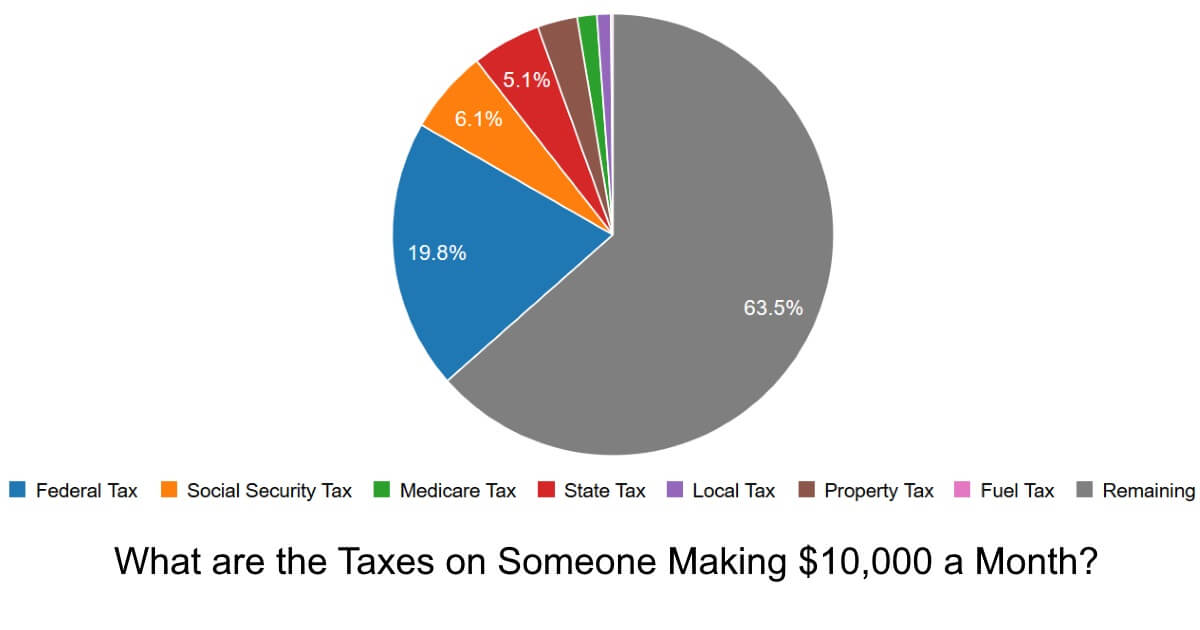

What are the Taxes on Someone Making $10,000 a Month?

December 12, 2016

Issue 9 Dayton Income Tax Increase - Nov 8 2016 Election Ballot

October 18, 2016

The City of Dayton is asking is residents and workers for another 0.25% of their income this November. Currently the rate is 2.25% - one of the highest in Ohio - so, if the tax is passed, the rate would climb to 2.5%.