Child Tax Credit and Dependent Care Expenses Credit Gutted for 2023

This site utilizes Google Analytics, Google AdSense, as well as participates in affiliate partnerships with various companies including Amazon. Please view the privacy policy for more details.

So I’ve started doing my Federal taxes and I had a bit of a sticker shock, at least when comparing it to my previous year’s Federal taxes.

It seems that the Child Tax Credit and Dependent Care Expenses have been gutted for 2023 - that is, tax year 2022 that everyone will be filing in 2023.

I guess I knew this was coming - especially the child tax credit part - but it was still something to see.

Child Tax Credit and Credit for Other Dependents

This is reported on schedule 8812 and calculated on the line 5 worksheet in the instructions.

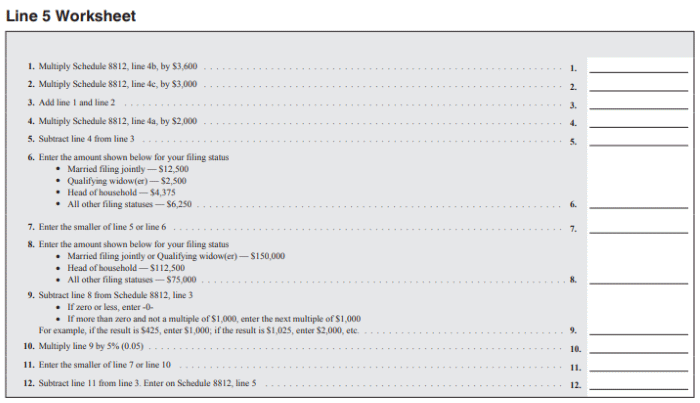

The oh-so-simple line 5 worksheet to determine your child tax credit in 2021

The oh-so-simple line 5 worksheet to determine your child tax credit in 2021

For tax year 2021, you could get a credit of $3,000 per kid under 18 with a bonus $600 if the kid was under 6 years old.

That means for each kid under six, you could get a credit of up to $3,600.

The credit did begin to taper off at a rate of five cents for each additional dollar made above a certain amount. That “certain amount” was $150,000 for married filing jointly or qualifying widow(er), $112,500 for head of household, and $75,000 all other filing statuses.

So if you file jointly with your spouse and made $200,000, you’d have to reduce your credit by $2,500 (5% of the amount above $150,000, which is $50,000).

I have two kids under six, plus my wife and I made under that $150,000 threshold, so that means we got a credit of $7,200.

However, for the 2022 tax year (which is everyone will be filing this year, if you’re reading this in the beginning of 2023) $2,000 per kid under 18 with no extra for younger kids. (And the calculation is simpler and done on the form itself - no line 5 or other worksheet.)

The much-simply - but more costly - calculation to determine your child tax credit in 2022

The much-simply - but more costly - calculation to determine your child tax credit in 2022

It does taper of at a rate of five cents for each additional dollar made above a certain amount, but that “certain amount” is higher than in 2021. It’s now $400,000 for married filing jointly and $200,000 for all other filing statuses.

So this year I’m only getting a $4,000 credit for two kids instead of the $7,200 I got last year.

Child and Dependent Care Expenses Credit

This is reported on form 2441.

In 2021, the amount you could deduct maxed out if you spent more than $8,000 if you had one qualifying kid or $16,000 if you had two or more kids.

Kids are only qualifying if they attend a paid-for daycare. So if you pay for one kid’s daycare, but somehow get free daycare for the other, then only one counts towards the max spent.

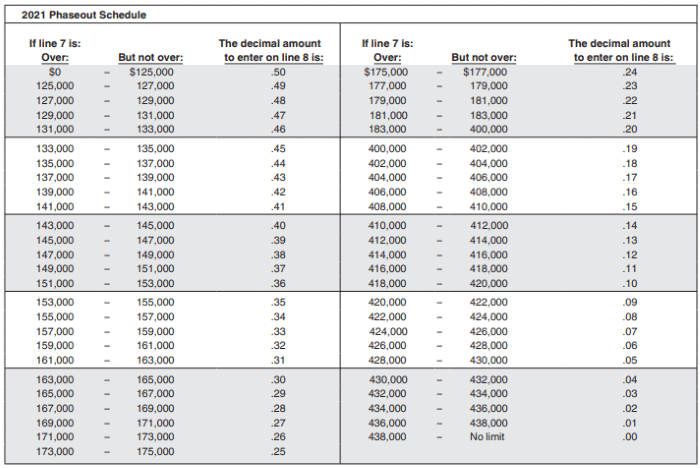

As far as the credit goes, you could take a credit up to 50% of qualified expenses. The rate you can take a credit does begin to tapered off at an increasing rate after $125,000 of income (approximately one percentage point for every extra $2,000 of income, although there’s a big jump at the 20% mark).

The Phaseout Schedule from the 2021 Form 2441 Line 8 Instructions - note the big gap at the 20% mark on the upper right.

The Phaseout Schedule from the 2021 Form 2441 Line 8 Instructions - note the big gap at the 20% mark on the upper right.

So the largest possible credit someone could take was if:

- They had two or more kids that they’re paying for daycare.

- The spent more than $16,000 on the daycare.

- The had an income of less than $125,000.

In that case, they’re credit would be half (50%) of the $16,000 - or $8,000.

I only spent $1,694 in “qualified” expenses and my income was just enough above $125,000 to only be able to deduct 49% of the cost, so I could only get a credit of $830.

For 2022, the credit was reduced significantly both in the amount of expenses that qualified and the percentage you could claim.

First, the amount you could deduct maxes out if you spent more than $3,000 if you had one qualifying kid or $6,000 if you had two or more kids.

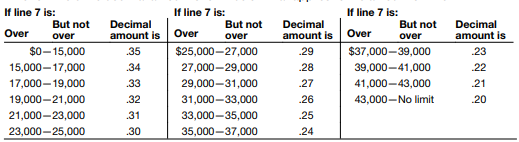

Then you can only get a credit up to 35% of qualified expenses if you make less than $15,000. It does goes down 1 percentage point for every $2,000 of extra income until it reaches 20% after $43,000; it remains 20% for all incomes above $43,000.

Table from line 8 on the 2022 Form 2441 showing the rate you can deduct versus your income.

Table from line 8 on the 2022 Form 2441 showing the rate you can deduct versus your income.

So the largest possible credit someone could take was if:

- They had two or more kids that they’re paying for daycare.

- The spent more than $6,000 on the daycare.

- The had an income of less than $15,000.

In that case, they’re credit would be 35% of the $6,000 - or $2,100. That’s a big drop from $8,000.

I spent a bit more in “qualified” expenses for 2022 in 2021 - about $15,000. My income is also well over $43,000.

That means I get a credit of 20% of the max amount ($6,000) - which comes out to $1,200.

Which is more than last year, but only because I spent so much more.

Disclaimer

Always, always, take the advice of a tax professional before what a random blog post on the Internet says.

This post does not constitute advice, and is for informational purposes only.

Leave a Reply