What is this "5-Section 199A dividends" line on my 2019 Robinhood 1099-DIV?

This site utilizes Google Analytics, Google AdSense, as well as participates in affiliate partnerships with various companies including Amazon. Please view the privacy policy for more details.

Robinhood messed up. Or maybe it was the government. But in either case, Robinhood ended up sending me two sets of 1099s this year - an original one, and a “corrected” one.

Well, they actually sent me three - “Robinhood Crypto” sent me one, whereas “Robinhood Securities” sent me the two.

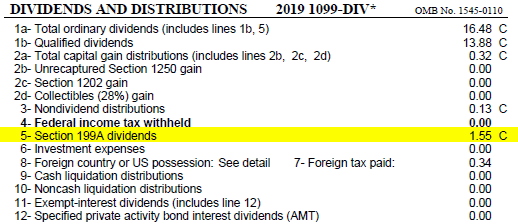

What confused me was this “5- Section 199A dividends” line:

My 2019 Robinhood 1099-DIV

My 2019 Robinhood 1099-DIV

On the original 1099-DIV it didn’t matter since the line had a value of $0.00. But the corrected value has a value of $1.55.

Does this mean I have to pay extra tax on this buck-fifty-five? Or perhaps… Less?

It turns out the answer is technically neither (the buck-fifty-five was not enough to affect my taxes) but if it were five or more dollars, I would have ended up owing less tax.

This buck-fifty-five “Section 199A dividends” was from a couple of shares of REIT called New Residential Investment (NRZ), which I picked up the first share back in November 2018.

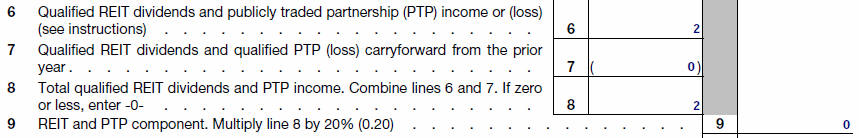

It turns out I report this buck-fifty-five on line 6 of IRS Form 8995.

Line six reads:

6 Qualified REIT dividends and publicly traded partnership (PTP) income or (loss) (see instructions)

The instructions for line six merely read “Enter income as a positive number and losses as a negative number” - however, there is this section earlier in the instructions:

Determining Your Qualified REIT Dividends and Qualified PTP Income/ Loss

Qualified REIT dividends include any dividends you received from a REIT held for more than 45 days and for which the payment isn’t obligated to someone else and that isn’t a capital gain dividend or qualified dividend, plus your qualified REIT dividends received from a regulated investment company (RIC). This amount is reported to you on Form 1099-DIV, line 5.

See that last bit? This amount is reported to you on Form 1099-DIV, line 5. That’s what I’m looking for!

It turns out I get to deduct from my income 20% of the “qualified REIT dividends” I received. This was new last year (Tax Cuts & Jobs Act thing) and form 8995 is a new form for this year (last year it was a worksheet that you didn’t file).

Lines six through seven of Form 8995 help you calculate how much you can deduct:

6 Qualified REIT dividends and publicly traded partnership (PTP) income or (loss) (see instructions)

7 Qualified REIT dividends and qualified PTP (loss) carryforward from the prior year

8 Total qualified REIT dividends and PTP income. Combine lines 6 and 7. If zero or less, enter -0-

9 REIT and PTP component. Multiply line 8 by 20% (0.20)

Everything is rounded to the nearest dollar, so my $1.55 becomes $2.00, and 20% of two bucks is $0.40 - which, being rounded to the nearest dollar, is a big fat zero.

In other words, the following are lines six through nine for me:

My Form 8995, Lines 6, 7, 8, and 9

My Form 8995, Lines 6, 7, 8, and 9

So I get no extra deductions for my buck-and-a-half of qualified REIT dividends.

Want a Free Stock?

I have a couple of referral links you can use if you want a free stock. Namely, WeBull and Robinhood. So sign up for one and earn a free stock - or sign up for both and earn two!

Leave a Reply