Questions I Had About the Chase Amazon Prime Visa

Prime Day just happened, so I wanted to grab the Chase Amazon Prime Visa while the bonus was higher than normal.

Writing What I Want

Prime Day just happened, so I wanted to grab the Chase Amazon Prime Visa while the bonus was higher than normal.

2025 is here. Now that 2024 is complete, I can look and see how much I made doing things outside of normal employment.

Recently, Vanguard announced the end of their solo 401k program, which left me with a decision to make about my solo 401k account. Should I just close it? Transfer the money to my IRA? After some research and consideration, I decided to transfer my solo 401k account to Fidelity. Here’s a detailed account of my experience during this transition.

A few weeks ago there was a meme floating around about if you spend using a physical $50 bill, it will remain a fifty dollar bill. But if you spend that same fifty bucks with a credit card - that fifty bucks gets whittled away by credit card processing fees and bank fees and just because fees.

Mint, the personal finance app, has announced they’re shutting down January 1st, 2014.

Why do i always read those “How to Make Passive Income” news articles and blog posts?

So Ohio Governor Mike Dewine signed Ohio House Bill 33 on July 4th. This bill is Ohio’s budget for fiscal years 2024-2025.

So I’ve started doing my Federal taxes and I had a bit of a sticker shock, at least when comparing it to my previous year’s Federal taxes.

Interest rates are rising. I Bonds are paying 9.62%. A couple of months ago I opened a 5-year CD at 2.9%. I just got an email from my credit union about a 3.2% 23-month CD.

So it seems that Worthy Bonds is having liquidity problems.

Having is not so pleasing a thing as wanting.

If you’ve ever dabbled in frugality, you’ve probably had the idea of unit pricing drilled into your head. Don’t pay too much attention to the total cost of something, but rather the cost per unit.

With the advent of “the stock marketplace” and the end of the automatic, passive stock back, Bumped is dee-eee-dee dead. Meaning the lucrative $300+ I’ve made with the app over the past couple years will not continue.

I love my online high-yield savings account. I’ve had the account a number of years now, and it was great when the interest rate was just over two percent. But over the past year, the interest rate has slowly been dropping, and now, it’s under one percent.

We all do it. Some of us try to limit it, some of us love to do it. If we do it too much, it can spiral out of control. And as much as anyone can try, no one can not do it.

One year ago I published a review for the Bumped App. At the time, I had only made $1.21.

A few months ago we bought a car, and although we got pre-approved financing with our local credit union, we ended up using a different bank when the finance guys at the dealership were able to get us a 0.2% better rate.

A few days ago, I went to my local Kroger fuel station to fill up my wife’s minivan and saw the following notice:

Within the past week, Dorco announced via email that they’re shutting down their website, DorcoUSA.com. The good news is that they will continue to sell Dorco razors via Amazon.

About nine months ago I wrote about how we bought a van. Well, over the weekend we bought a car.

WeBull is a zero-commission brokerage app - a competitor to Robinhood. One of the things that sets WeBull apart from Robinhood is the ability to paper trade.

Google AdSense. It seems like Google's AdSense advertising platform is the default mechanism that bloggers use to make money from their sites. It's an easy system to get into, but that is also a considerable part of the problem. It's too easy. Today, we're going to talk about some AdSense alternatives.

Google AdSense. It seems like Google's AdSense advertising platform is the default mechanism that bloggers use to make money from their sites. It's an easy system to get into, but that is also a considerable part of the problem. It's too easy. Today, we're going to talk about some AdSense alternatives.

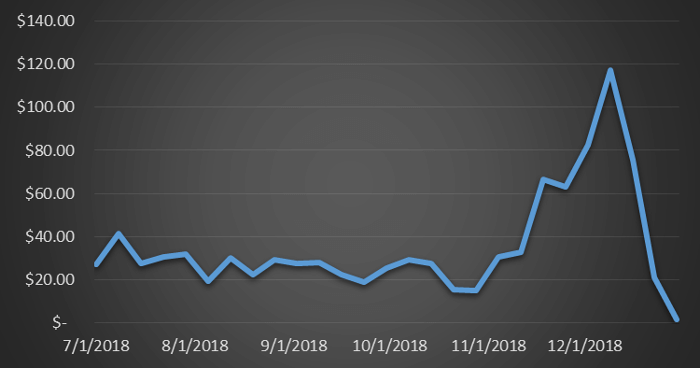

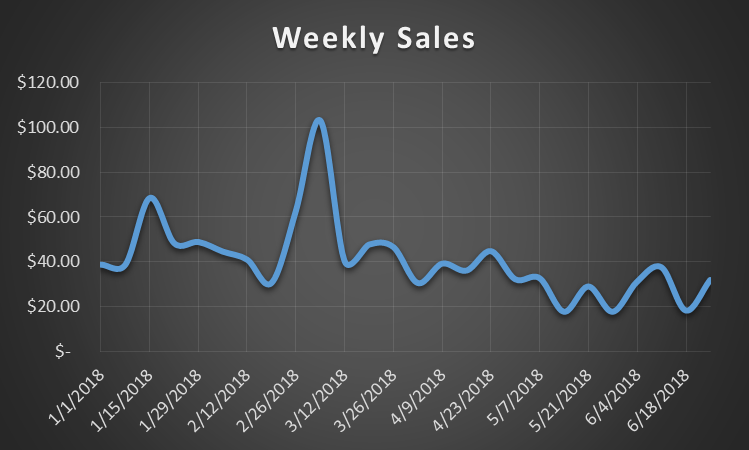

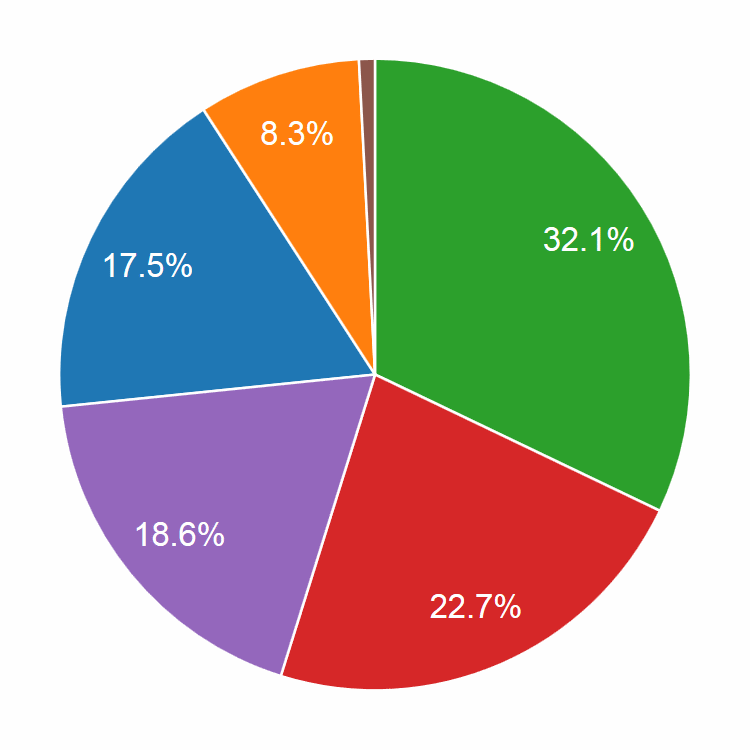

It’s been a few days over six months since my First Half 2018 Merch by Amazon Sales Report, which means it’s time to report on the second half of 2018. The second half of 2018 (in fact, the second half every year) contains the coveted “Q4” or fourth quarter, with the Christmas and Holiday shopping season.

This is my third annual End of Year Side Income Report which means this blog has been around for at least three years. In actuality, it’s been around for four - my first post for this instance of my blog was on September 2, 2015, although I have pulled some old posts from my old blog.

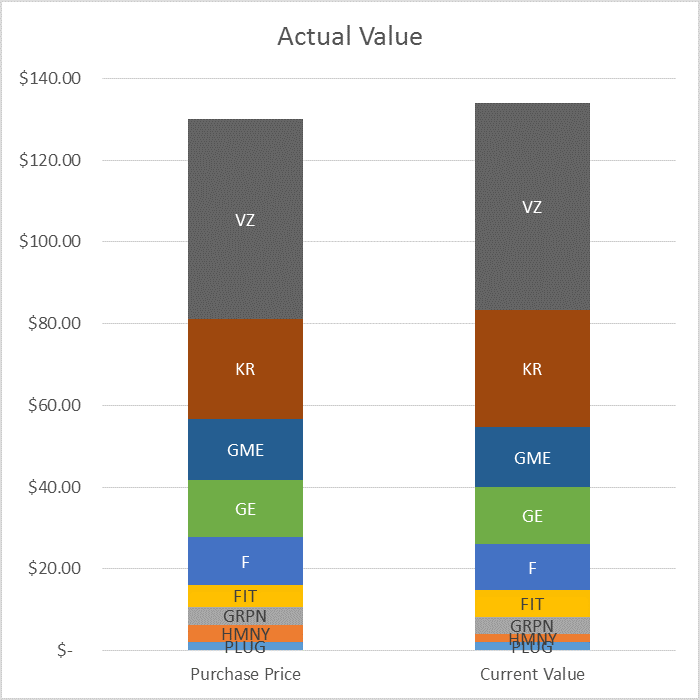

This sixth monthly edition of “My Robinhood Stock Picks” will probably be the last for a while. With my recent purchase (and financing) of a minivan, as well as the fact I have a more tax-advantaged Individual 401k to put money in that I’ve nowhere near maxes out, I think my money has better use elsewhere.

Of all the cashback portals available on the Internet, Ebates is probably the most well-known. And it should be since it was one of the first, if not the first, cashback portals - founded in 1998, during the dot-com bubble.

Now that September is over, it’s time to take a look at my Robinhood account and check on its performance. For those that are new to my blog, I’ve been making these monthly updates since my first full month of buying stocks on Robinhood in June of this year. That means this is the fourth post in the series.

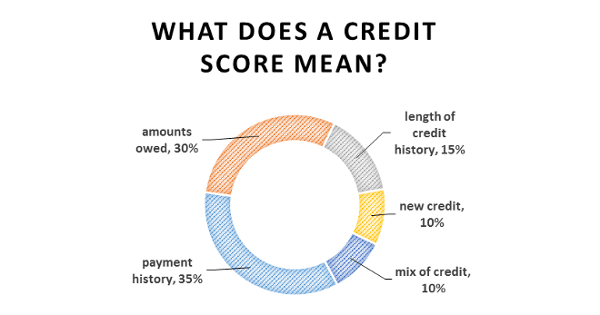

It’s the little three-digit number that people obsess over as if it’s the final grade in the school of life. It affects the interest rate of loans you may get - or even if you qualify for a loan in the first place. Nowadays, it can even affect things not normally associated with “credit” such as insurance and utilities.

I’ve been having a bit of success recently selling my t-shirts on Amazon, so I decided it was time to do something with this income. And that something is sock it away for a rainy day - or more accurately, retirement.

Recently my brother was telling me about a deal he received on financing a new truck. He had gone to the dealer to browse and possibly buy, and after a bit of negotiation with the salesperson, agreed to a price of $20,000* at 0% interest for 60 months. However, the dealer was unable to actually approve him for 0% interest, so my brother shrugged his shoulders and proceeded to walk.

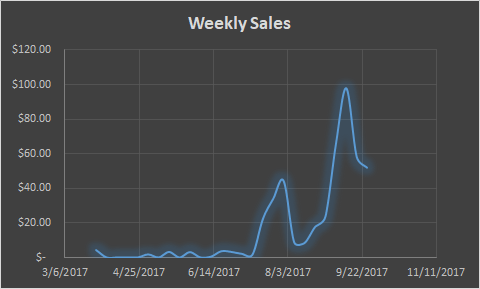

Almost a year ago now I wrote a post about my first seven months on Merch by Amazon. Since then, I’ve written nothing. I was thinking about doing monthly reports, but each month quickly went by, especially with the birth of my son.

At the end of last month - the last day, in fact - I signed up for a Robinhood account. I signed up mostly for fun - but also for the free stock that Robinhood is currently offering. I got Chesapeake Energy (CHK), which is worth only about five bucks. However, some people get stocks worth a couple hundred dollars, such as Facebook or Apple.

In the quest to pay debt off as quick as possible, people try to find unique ways (“hacks” if you will) to reduce the timeframe and interest charged. The most popular - and successful - method is the snowball method or one of its variants. Another trick is to split the payments into two or more payments a month.

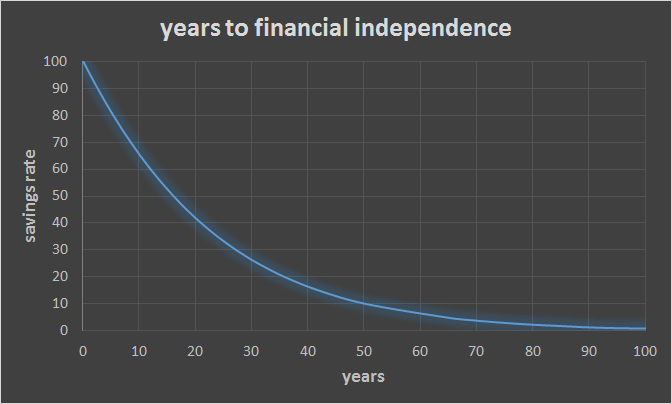

One of the more popular articles in the financial independence blogosphere is Mr. Money Mostache’s The Shockingly Simple Math Behind Early Retirement. If you haven’t read it, check it out. While I found it interesting, I think that the simple math is lacking, well, math, so I wanted to dig a bit deeper and figure out where the numbers came from.

Should you buy LED bulbs? What about replacing an old vehicle with a more fuel-efficient vehicle? When exactly is an energy efficient upgrade worth the investment? While part of these questions has environmental and safety considerations - making the answer a definite “it depends” - the financial aspects are a little more straight-forward. Essentially the answer is “yes” if the item - LED bulbs, a car, or what have you - pays for itself in a certain time frame.

Yet another income report. Well, for this blog, it’s only the second one - my previous one was last year’s end-of-year income report. Income reports still seem to be a popular topic in the blogosphere, although most who do income reports do monthly income reports rather than yearly income reports.

Earlier this year I become interested in the cryptocurrency scene, particularly bitcoin. In addition to buying some bitcoin on Coinbase, I also bought an AntMiner S3 on eBay. I was using the AntMiner via the NiceHash service, but after the recent hack, I decided to move to an actual pool. After a very short amount of research, I decided to go with SlushPool, which is one of the older pools.

Ever being the entrepreneur, I’ve been playing around with Amazon’s Print-On-Demand service Merch by Amazon. I’ve been doing this since March - although I believe I requested an account sometime late last year - and in my first four months, I had lackluster sales. Hell, I had no sales at all in the month of April!

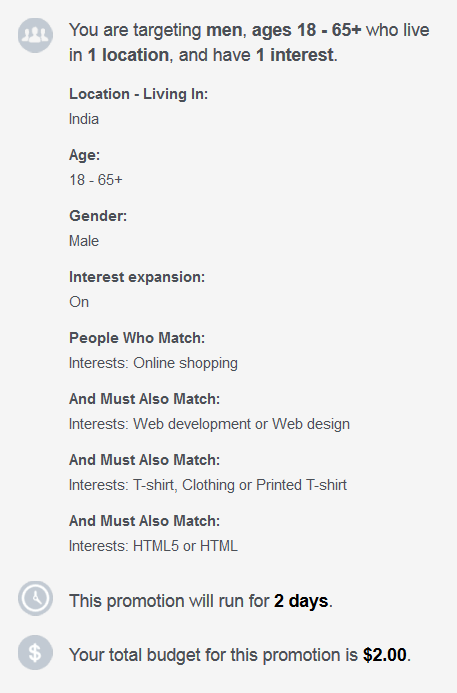

I’ve run a few Facebook ads before, never spending more than a couple bucks and never with much success - either in terms of views, likes, or clicks. Inspired by this blog post on MerchInformer.com, I decided to expand my audience beyond the United States.

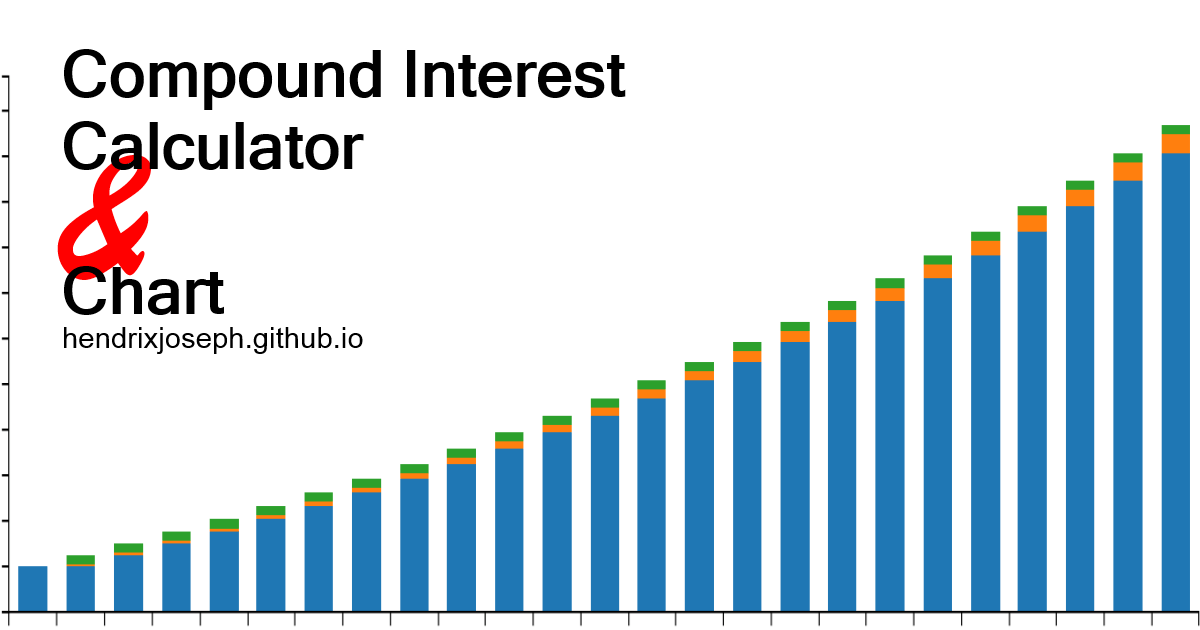

For fun, I created this compound interest calculator with a chart. Just enter your values in the form below the chart, hit submit, and it will display your results.

Last October I posted about my electric bill over the year. In order to save money, I switched my supplier from DP&L to AEP via Ohio’s Apples-to-Apples website, lowering my costs from 7.3¢ to 4.59¢ per kilowatt.

One popular reoccurring post on blogs, regardless of niche, is an income report. For instance, MyBlogLift has a monthly (well, two) income and traffic report. Cash Flow Diaries has a long list of different income reports.

In an ever long pursuit to diversify my income (I’m already signing up for checking accounts just for the bonuses as well as buying and reselling things on eBay), I’ve taken up the hobby of designing t-shirts. I only have three so far (well, I have a first one, but it was more to learn the platform), and none have sold. Not surprising since I only launched one yesterday and two today.

Earlier this year I started a new hobby - flipping things I find at garage sales, thrift stores, and even regular retail stores. Flipping essentially means I sell it elsewhere more than what I paid for. I sell most of these items on eBay, and some on Amazon, which means I need to ship these items. There are a few things I’ve found essential for shipping, and here’s a list of six of them:

The City of Dayton is asking is residents and workers for another 0.25% of their income this November. Currently the rate is 2.25% - one of the highest in Ohio - so, if the tax is passed, the rate would climb to 2.5%.

Charting the Snowball Method of Paying Off Debts

Charting the Snowball Method of Paying Off Debts

For fun (and profit!) I’m trying to see how many checking bonuses I can get. Since it’s super easy to set up direct deposit at work - it’s just through a web portal - I can add, remove, or change the amount going into bank accounts at will. I got to keep track of what accounts I have open. Just to get an idea of what I’ve done, here’s a table:

An updated table from the previous post plus two more scenerios.

Just a table on what the effect of increasing a wage would be. It is assuming that it takes one hour to make one loaf of bread.

If you read my previous blog on the economy, you’ll see how I explain recessions as part of the inherent flaw of capitalism. As a recap, it is essentially because business people need to earn more than their customers, and their customers need to make more than the business people. This concept would make one wonder how capitalism works at all.

The sky is falling. Everyone’s losing their job. The dollar isn’t worth what it used to be. Everything’s doom and gloom. Yet economists and politicians seem to insist that this is all part of a cycle, which includes recessions, booms, depressions, bull markets, bear markets, and other mumbo jumbo.